Bitcoin Halving is Coming: What Does it Mean for the Crypto Market?

May 23, 2023

The blockchain industry is still complicated for many, with its own specific terminology and unique technological background. All these originated via Bitcoin, the world’s first technological breakthrough that began a brand-new age for digital currency. Because it was the first cryptocurrency, it cleared the way for the market of over 23,000 unique cryptocurrencies, giving millions of people freedom from traditional banking.

Getting rewarded for mining is an exciting part of making money with BTC. However, as with everything in this universe, nothing is permanent, and mining rewards are no exception. Once every four years, a phenomenon known as “Bitcoin halving” halves the incentives for mining Bitcoin.

But halving is more than that, and it has numerous advantages for the network and the market as a whole, so let’s discuss what halving is and what we may anticipate from the next one.

Key Takeaways

- The process of validating blockchain transactions is called mining, and halving is crucial in ensuring that the Bitcoin network’s supply and demand are always in equilibrium.

- The mining rewards are automatically halved every four years.

- Three previous halvings occurred in 2012, 2016, and 2020. A significant price spike followed each half of the Bitcoin supply.

- In early 2024, a further halving of Bitcoin’s value is predicted. The effect on mining profitability is unclear, although it may lead to higher prices.

First, How Does Bitcoin Blockchain operate?

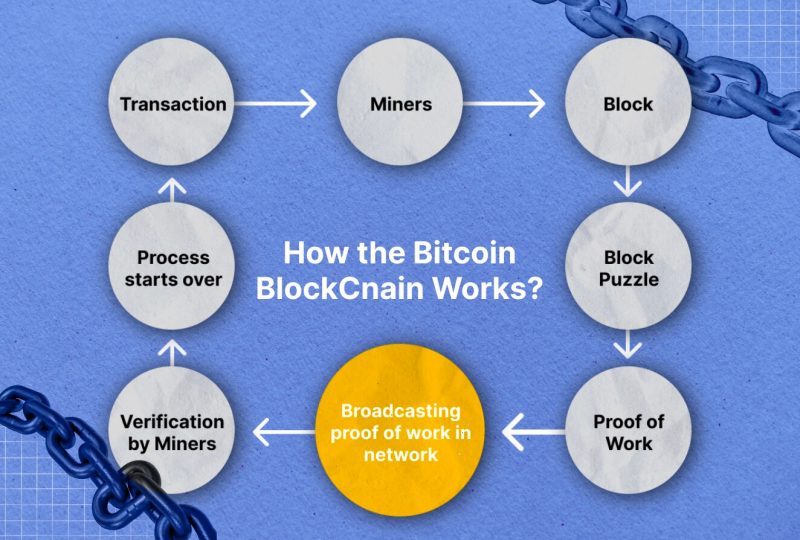

Understanding the inner workings of the BTC network is crucial to getting your head around the idea of halving Bitcoin. Blockchain technology, which at its heart, is essentially a decentralized ledger that records some or all transactions done inside the Bitcoin network. Many machines, called nodes, all running the Bitcoin software, oversee this ledger.

Each node in the Bitcoin network is essential to transaction validation. Since these nodes have access to the full blockchain, they can verify the validity of each transaction. These measures guarantee the transaction isn’t too long or complicated and satisfies all necessary validation requirements.

Note, that each transaction has to be approved separately. Once all of the transactions in a block have been verified, the process is considered complete. Once a transaction has been approved, it is put into the blockchain and broadcast to all of the network’s nodes.

As more computers join the blockchain, their security and trustworthiness improve. Anyone with enough storage capacity may participate in the Bitcoin network by downloading the whole blockchain and its transaction history. However, it should be noted that not all nodes perform the function of a miner.

Bitcoin miners use computers or specialized gear to validate and process blockchain transactions. The technique relies on something called proof-of-work (PoW), which gets its name from the fact that decrypting an encrypted hash takes work.

A new block is generated when a group of transactions is mined and verified. Following this, the nodes confirm the transactions, creating a sequential series of changes. This procedure creates a series of linked data nodes (the blockchain).

After each block is verified, miners receive a Bitcoin block reward for their efforts. As a result of this incentive, many people now see mining as a promising source of passive income. Nonetheless, these benefits are not fixed, which brings us to the fascinating phenomenon of halving.

Bitcoin Halving 101

Bitcoin halving is an automated mechanism that reduces the profitability of mining by half or the equivalent of what miners would earn if they spent twice as long mining a block. Blocks, which are files that each occupy 1 MB on the blockchain, are the units in which Bitcoin transactions are kept.

Every 10 minutes, the Bitcoin mining process is triggered to look for these new blocks. As the number of miners on the network rises, so does its aggregate hashing power and the time it takes to identify blocks. The mining difficulty is changed every two weeks or so, so a new block is found every 10 minutes.

Blocks are still being discovered on average in under 10 minutes, at roughly 9.5 minutes, despite Bitcoin’s network expanding exponentially over the previous decade.

The total number of Bitcoins that will ever be created is 21 million. When this cap is reached, no further Bitcoin will be created. The halving mechanism is essential here since it halves the reward for each Bitcoin mined in a block. This approach is intended to make Bitcoins more scarce over time, which might boost their value.

Why Does Bitcoin Halving Occur?

Bitcoin halving, an integral part of Bitcoin’s monetary policy, is often followed by considerable market fluctuations. This event reduces the number of new Bitcoins entering circulation, inherently boosting the value of the yet-to-be-mined Bitcoins. Such shifts present opportunities for market participants to potentially capitalize on.

Several reasons underlying the beneficial nature of Bitcoin halving:

- Controlled Inflation

The block reward in Bitcoin is scheduled to be halved about every four years. This technique keeps Bitcoin’s inflation rate stable and predictable. By reducing the number of newly minted Bitcoins, halving helps slow down inflation and keep Bitcoin’s scarcity high, both of which are good for its value.

- Scarcity and Value Appreciation

The block reward halving decreases the rate at which new Bitcoins are generated. This scarcity enhances the demand-supply dynamics, which could increase Bitcoin’s value over time. In previous halving cycles, prices rose sharply as traders anticipated lower supplies alongside increasing demand.

- Price Stability

Bitcoin’s price has a reputation for swinging wildly, but halving may eventually lead to more stable prices. As said, halving slows the supply increase by lowering the issuance of new coins.

As Bitcoin gains in popularity and market value, the decreasing quantity of Bitcoins may help to stabilize its rising price. If prices are stable, consumers, businesses, and institutions will be more likely to use cryptocurrency as a store of value and medium of exchange.

- Network Stability and Consensus

In the Bitcoin community, halving events are well-known and eagerly anticipated. The consensus process inside the network is strengthened by the halving’s predictability.

This makes sure that everyone plays by the same set of rules and receives coins at the same rate everyone anticipates. Because of this consistency and agreement, Bitcoin is more likely to be trusted, which can bring in more users and investors.

- Industry and Ecosystem Development

Bitcoin halving has a broader impact on the cryptocurrency industry and ecosystem. The event brings attention and media coverage to the cryptocurrency space, which can lead to increased awareness and adoption of not just Bitcoin but also other cryptocurrencies and blockchain projects. The increased interest can drive innovation, investment, and development within the industry, fostering a more robust and diverse ecosystem.

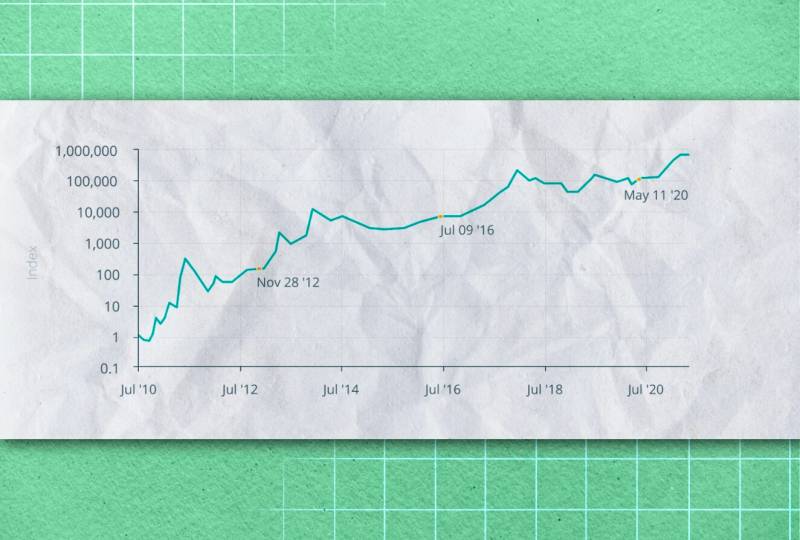

Bitcoin Halving Chart

Past Bitcoin Halving Dates

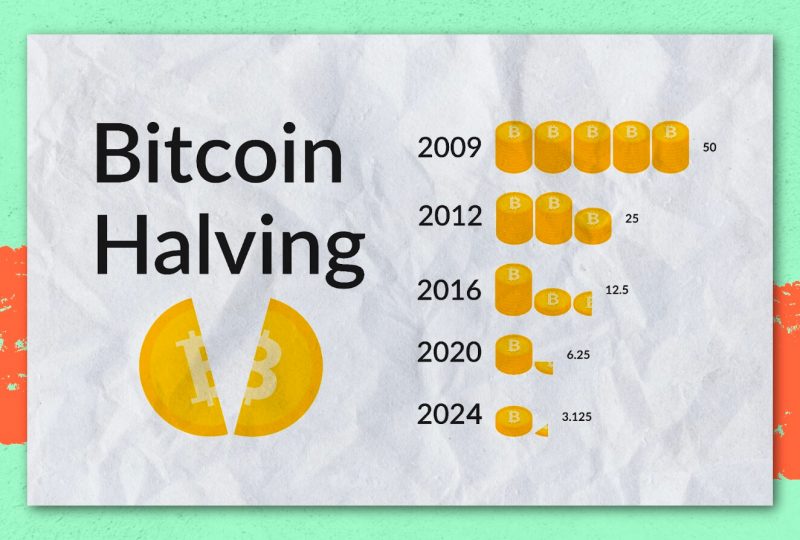

Bitcoin halving is typically a much-anticipated event within the crypto community, and historical instances vividly illustrate why. The inaugural halving occurred in November 2012, followed by the second in July 2016, and the most recent, third halving, in May 2020.

The financial implications of these events provide compelling insights into the potential effects of halving Bitcoin’s price trajectory.

In the wake of the 2012 halving, Bitcoin’s value witnessed an impressive surge of almost 800% within the subsequent year. This trend was not a one-time phenomenon. Following the 2016 halving, Bitcoin’s value soared by nearly 1,000%. The last Bitcoin Halving in 2020 mirrored this pattern, with Bitcoin’s price skyrocketing to approximately $70,000 by November 2021, a mere six months post-halving.

Upcoming Bitcoin Halving: What Should The Market Expect?

The Bitcoin halving schedule projects that the next halving will occur at block 840,000 on April 27, 2024, at 11:18:24 AM UTC. Since a new Bitcoin is mined every 10 minutes, the miner’s incentive will be reduced from 6.25 BTC to 3.125 BTC each block.

Until the cap of 21 million BTC is fully mined, which is expected to happen around 2140, the quantity of Bitcoin gets reduced by half every four years due to the halving event.

It is still difficult to estimate how the imminent halving will affect the value of Bitcoin. Many people expect the price of Bitcoin to increase when the halving occurs, since this has been the pattern after each of the previous three halvings. However, the demand for Bitcoin during the halving phase will determine how much the price of Bitcoin increases.

The crypto ecosystem has changed dramatically since the last halving in 2020, and this must be taken into account. More established cryptocurrencies are vying for investors’ attention, making for a lively and competitive market.

Will Mining Still Be Lucrative After The Next Bitcoin Halving?

Although halving is widely expected to have a favorable impact on the market and likely result in higher prices for Bitcoin and, by extension, altcoins, this optimistic attitude is not shared by everybody. The mining industry is one that often reacts negatively to halving occurrences.

Mining is expected to become unprofitable after 2023 as the returns on this labor-intensive activity are predicted to drop dramatically.

The hash rate of the network, which is a measure of its computational capacity and determines the difficulty of mining a block, is another important variable that will be affected by the halving. Some miners may leave the game if the payout for mining is halved, causing a decrease in the network’s hash rate.

It’s also possible that the surviving miners will find it simpler to mine blocks after this decrease. However, if only a few miners control the network, this might lead to even more centralization.

This is why many in the crypto world are excited about a halving, while miners are wary. The benefits for Bitcoin miners may not be worth it even if the price of Bitcoin considerably increases.

Mining Bitcoins may become less profitable as there are over a million people competing for the same rewards and rising criticism of mining’s excessive energy use.

Those that see mining as a lucrative business opportunity would do well to get started as soon as possible, while there is still time.

If All 21M Bitcoins Are Mined, Then What?

The question of what happens when all 21 million Bitcoins are mined naturally arises in the minds of those interested in the subject. The answer is as follows: Once the full supply of 21 million Bitcoins has been mined, the reward for validating a block will simply end.

However, miners will still receive compensation through transaction fees paid by those engaging in Bitcoin transactions. The projected timeline for the final Bitcoin to be mined is the year 2140, marking the end of an era for this widely popular activity and closing a lucrative door for many.

It is worth noting that even after the full supply is exhausted, there may still be utility for the expensive mining rigs that are currently used. Many other cryptocurrencies and blockchain networks operate on a similar Proof-of-Work consensus mechanism and require mining efforts. Therefore, these mining rigs may find new purposes in supporting other projects in the decentralized landscape.

Final Takeaway

Without question, the halving of Bitcoin’s supply is a big deal for the blockchain. It is crucial to keep supply and demand in equilibrium. Halving is the primary technique for controlling the issuance of the initial crypto asset. It helps establish conditions amenable to healthy competition among miners and lucrative trading on the crypto market.

Although the halving’s precise results are difficult to predict, and the past is never a real example for the future, most of the market thinks that BTC halving will positively influence BTC price and spawn a bunch of crypto millionaires in the market.